How to Find My Account Number Consumers Credit Union

New Member FAQ

2. How do I register for personal online banking?

- www.myconsumers.org

- In the upper right corner of our website, click on the "Online Banking" button.

- Click on the "Register Consumer" option and fill out the requested boxes, including the requested User ID (must be at least 6 characters long and cannot be your member number or account number).

- You will be asked to accept the online banking disclosure.

- Next you create a Password (must be at least 8 characters long with a combination of letters and numbers).

- You will then be able to see your accounts online moving forward.

For assistance with registering for online banking, please visit our user guide for step-by-step instructions.

3. How do I register for business online banking?

- www.myconsumers.org

- In the upper right corner of our website, click on the "Online Banking" button.

- Click on the "Register Business" option and fill out the requested boxes, including the requested User ID (must be at least 6 characters long and cannot be your member number or account number).

- You will receive an email within 3 business days with a one-time temporary password.

- You will be asked to select a new password upon your first time logging in. Password must be at least 8 characters long with a combination of letters and numbers.

- You will then be able to see your accounts online moving forward.

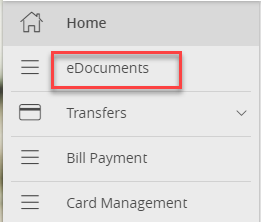

4. How do I enroll in e-Documents?

- Log into online banking using the User ID and password you created.

- Click on the "eDocuments" tab in the left pane.

- Enter your email address in the first box and it will pre-fill the other boxes for you.

- Enter the verification number listed.

- Lastly, you will be asked to check the box and register for electronic documents.

5. How do I start my direct deposit?

- You will need to set up direct deposit through your employer. Your employer will need Consumer's routing number and your full account number.

- Our routing number is 271989950.

- Your account number was sent to you in a separate email upon account opening.You may also obtain this information in online banking under the "View Accounts" tab.

- Give both of these numbers to your employer to initiate direct deposit.

- Generally takes 1-2 pay periods for implementation.

7. How do I order checks?

The first check order must be placed by a Consumer's employee and there is a cost. For personal accounts, please call 1-877-275-2228 to place an order. For business accounts, the first order must be placed in person at one of our convenient locations. After the first order is placed, you may order replacement checks via your online banking. We also offer free online bill payment, accessible via online banking.

9. What is the difference between a credit union and a bank?

Banks operate to generate profits for their stockholders or private owners. Credit unions are not-for-profit financial cooperatives, owned and operated by the Members. Credit union profits are returned to their Member-owners in the form of higher deposit rates, lower loan rates, and no or low cost services. Banks are federally insured by FDIC; credit unions are federally insured by NCUA.

11. Why is five (5) dollars held in my savings account?

$5 is held in your regular Savings Account as your initial share deposit and signifies your ownership of the Credit Union ($5 = 1 share). This $5 minimum balance is your money and will be returned if you should ever close your membership.

12. What are the ways to access my account?

As a new Member, there are several ways to access your account while waiting for your debit card to arrive. Beyond traditional Branch access, Consumer's offers online, mobile, and text banking, telephone teller, shared branching, and Mobile Check Deposit.

14. What is Mobile Check Deposit and how do I use this service?

CCU is proud to offer our no-cost mobile check deposit service! It provides the convenience of depositing checks via your home office or mobile phone. Just capture an image of the check, submit it using CCU's secure system and "voila" you made a deposit! To apply for this service, please call our Contact Center at 877-275-2228. CCU's Mobile App is available for both iPhone and Android users.

*All mobile check deposit users must qualify for the service. Deposits are subject to CCU Funds Availability Policy. All items are reviewed before posting. Deposits made during non-business hours will be posted on the next available business day. Members must be enrolled in eDocuments and have accepted the eDocuments disclosure. Consumers Credit Union reserves the right to review credit history as part of the qualification process for mobile check deposit.

16. What is text banking?

Text Banking is an easy, fast and secure way of banking while using your phone's texting capabilities. With Text Banking, you can check balances and view recent account transactions on the go!

You can enroll in Text Banking via Online Banking or via the CCU Mobile App. Once logged into Online Banking or our Mobile App, go to Settings and find the Text Banking option. You will need a mobile phone with texting capabilities. Standard messaging and data rates may apply. CCU's Text Banking number is 29137.

17. When are my funds available in my account?

Your initial deposit is available within 5-7 business days. As a new account, all checks deposited into the Credit Union will be held for 5-7 business days. After you have maintained your account for 30 days, check holds will be at the discretion of the Credit Union.

18. How do Free Rewards Checking Account tiers work?

To earn the 2.09% APY on balances up to $10,000 and ATM refunds complete the following requirements:

- Complete at least 12 Debit/Check Card point-of-sale purchases each month.

- Direct deposits, ACH credits, or mobile check deposits totaling $500 or more must post to your account monthly.

- Receive eDocuments (enroll and accept the disclosure)

To earn 3.09% APY on balances up to $10,000 and ATM refunds perform the following each qualifying cycle:

- Simply meet the requirements to earn 2.09% APY . . . then add:

-

$500 CCU Visa Credit Card purchases, no minimum number of transactions

To earn 4.09% APY on balances up to $10,000 and ATM refunds perform the following each qualifying cycle:

- Simply meet the requirements to earn 2.09% APY . . . and

- Spend $1000 or more in CCU VISA credit card purchase transactions, regardless of the number of purchases

19. What are other benefits of Free Rewards Checking?

- Free VISA Debit Card

- Free mobile banking

- Free online banking and bill payment

- Free e-Documents

- Unlimited check-writing privileges

- Access to over 1,800 Shared Branch Networks and nearly 30,000 surcharge FREE ATMs

- Qualified Members receive Courtesy Pay, a helpful resource that covers your overdrawn checks (fees apply)

How to Find My Account Number Consumers Credit Union

Source: https://www.myconsumers.org/about/about-us/new-member-faq's

0 Response to "How to Find My Account Number Consumers Credit Union"

Post a Comment